September 2024 – Issue 228

Global Securities

Services

Dear Clients and Partners,

It’s my pleasure to have this opportunity to write a brief introduction to this quarter’s version of the Global Securities Services (GSS) Newsletter. While my focus and responsibility are on all of the exciting changes underway and upcoming, relating to the Group’s digital strategy, it’s also fitting to present to you this Newsletter in a brand-new, and greatly improved format which we trust will be well-received and greatly appreciated by all of our readers.

As many of you will already be aware, Unicredit’s Digital Strategy has facilitated GSS to replace its legacy mainframes across CEE to a new, centralized Digital Platform, namely BANCS, and, in turn, this now enables us to accomodate several important milestones both near and long-term.

Client Solutions is a division of UniCredit Group and consists of UniCredit S.p.A., UniCredit Bank GmbH, UniCredit Bank GmbH London Branch, UniCredit Bank GmbH Milan Branch and other members of UniCredit Group. UniCredit Group and its subsidiaries are subject to regulation by the European Central Bank. UniCredit S.p.A. is regulated by Banca d’Italia and supervised by the Commissione Nazionale per le Società e la Borsa (CONSOB). In addition, UniCredit Bank GmbH is regulated by the Federal Financial Supervisory Authority (BaFin), UniCredit Bank GmbH London Branch is authorised and regulated by the Financial Conduct Authority (FCA), and UniCredit Bank GmbH Milan Branch is also regulated by Banca d’Italia and supervised by the Commissione Nazionale per le Società e la Borsa (CONSOB).

This publication is intended for marketing purpose only and it is published by UniCredit Group. Under no circumstances may the information contained in the published material be construed as an offer, recommendation, invitation to offer or promotional message for the purchase, sale or subscription of financial products. This marketing communication is directed solely at investment professionals and constitutes a “non-retail communication” for the purposes of the relevant rules.

© 2024 UniCredit S.p.A. - All Rights reserved

UniCredit

General Company Info

Privacy

Disclaimer

Accessibility

BANCS as a cloud platform will also include robust disaster recovery features, helping Compliance to meet industry regulations and centrally investing in cybersecurity to safeguard data.

Access to cutting edge technologies remains a key focus for Unicredit as a whole. Cloud platforms offer services tied to artificial intelligence (AI), machine learning and big data and help our business, as well as the entire industry, innovate faster without needing to build individual solutions from scratch.

Head of Product Development �& Project Coordination, �Global Securities Services

Katalin Bóta

UniCredit has reconfirmed its status as Best Sub-Custodian Bank in Central and Eastern Europe in Global Finance Magazine’s annual awards, while also claiming six country awards for Best Sub-Custodian Bank in Austria, Bosnia & Herzegovina, Bulgaria, Hungary, Serbia, and Slovenia.

The criteria include customer relations, quality of service, competitive pricing, smooth handling of exception items, technology platforms, post-settlement operations, business continuity plans and knowledge of local regulations and practices. The awards are determined by Global Finance’s editorial board, while input is also obtained from users of sub-custody services.

UniCredit named Best Sub-Custodian in CEE

UniCredit wins the award for the 15th consecutive year

HIGHLIGHTS

The Sarajevo Film Festival: A Hub of Southeast European Film

Initiated by Obala Art Centar, the inaugural Sarajevo Film Festival took place in 1995, during the four-year siege of Sarajevo. The first Sarajevo Film Festival was a bold statement of defiance against the war and an effort to help civil society recover. Its founders believed that cinema had the power to unite people, even in times of great adversity:

Three decades later, the Sarajevo Film Festival stands as one of Southeast Europe’s most prestigious cinematic events and the leading film festival in the region. Each August, it brings filmmakers, cinephiles, and artists from across the globe to Bosnia and Herzegovina’s capital.

Bosnia Herzegovina

NAVIGATOR ARTICLE

Prominent attendees over the years have included internationally acclaimed directors, actors, and producers such as Angelina Jolie, Robert De Niro, Brad Pitt, Morgan Freeman, Gael García Bernal, Béla Tarr, Meg Ryan, and many others.

The 30th edition of the Sarajevo Film Festival, held this August, screened more than 250 movies from around the world and attracted over 150,000 visitors. While the festival’s main mission is to promote and support filmmakers from Southeast Europe, its role extends beyond this by fostering dialogue between different cultures, ideologies, and generations.

The Human Rights Day program, through its panel discussions, workshops, and movie showcases, promotes human rights and provides opportunities for participants to discuss topics ranging from human rights and politics to gender equality and media. Additionally, the “Human Rights Award” is presented as part of the Competition Program to the best film dealing with subjects related to human rights.

Included in the Competition Program are the “Heart of Sarajevo” awards, which are presented in several categories for the best feature, documentary, short, and student films. The “Honorary Heart of Sarajevo” is an award presented to recognize individuals for their outstanding contributions to the film industry and their support of the festival. This year, Meg Ryan, John Turturro, Alexander Payne, Elia Suleiman, Christof Papousek and Philippe Bober received the award for their exceptional contribution to film art.

Beyond its contribution to the film industry, the Sarajevo Film Festival plays a crucial role in shaping the cultural identity of Sarajevo and Bosnia and Herzegovina as a whole. Each summer it transforms Sarajevo into a bustling center of international cinema, filled with tourists, media, and celebrities.

The Bank Association of Slovenia organised the regular annual conference for treasury, custody, investment banking and asset management industry. The conference was held on 11 April in City Hotel in Ljubljana.

The conference covered various topics related to financial markets, such as an overview of macroeconomic and monetary policy on the EU level, Strategy for the development of the capital market in Slovenia, ESG development and impact on financial institutions.

The event featured several key presenters who addressed the following:

Slovenia

NEWS

Representatives from the Slovenian treasury, custody, investment banking and asset management industries met at their regular annual conference in April 2024

The attendees addressed topics spanning from Market Development �to ESG Integration

The Ministry of Finance of the Republic of Slovenia delved into the challenges associated with implementing the Strategy for the Development of the Capital Market in Slovenia for the period 2023 – 2030. They also discussed the Ministry's activities concerning government bonds.

The Bank of Slovenia provided insights into the country’s economic outlook, forecasting GDP growth for Slovenia in the period 2024 – 2026 to range between 2% and 2.5%, surpassing the projected growth for the Eurozone at 1.5%. Additionally, core inflation in Slovenia is expected to decline from 4.5% to 3% during the same period, a rate higher than the Eurozone’s projected decrease from 3% to 2%. The European Central Bank (ECB) is expected to initiate interest rate cuts in the second half of 2024.

The Securities Market Agency highlighted pending amendments to the Market in Financial Instruments Act. This includes the implementation of MiFID II amendments due to the Regulation on a pilot regime for market infrastructures based on distributed ledger technology (DLT MTF and DLT TSS), and the implementation of Directive 2004/109/ES, as amended by the EU Corporate Sustainability Reporting Directive (CSRD). They also discussed the CSDR Refit, which will increase cash penalties, and the EMIR Refit. Furthermore, they noted that while the US market has transitioned to a T+1 settlement cycle, European markets are expected to follow suit in the coming years.

An ESG round table focused on the development of ESG in Slovenia, examining the current status and the integration of ESG into the operational processes of financial institutions. The round table also explored the challenges and opportunities linked with green investments.

Slovenia

Serbia

Bulgaria

Romania

Hungary

Slovakia

Czech Republic

expected acceleration of economic growth in the current year and the following years, with the contribution of both private and public investments to that growth;

inflation that has returned to the limits of the National Bank of Serbia’s target and its expected further decline, which will enable additional easing of monetary policy;

the continual strengthening of the external position as a result of inflows based on foreign direct investments, as well as the continuation of the downward trajectory of the share of public debt in the gross domestic product, despite higher state capital expenditures

the continual strengthening of the external position as a result of inflows based on foreign direct investments, as well as the con-tinuation of the downward trajectory of the share of public debt in the gross domestic product, despite higher state capital expenditures;

Author

One key milestone will be in gradually moving various BANCS modules to cloud technology, which will enable us, in a cost efficient manner to scale our system up and down based on actual needs and will also allow for dynamic resource allocation. Worldwide cloud data centers enable our end users to be closer to services and facilitate better performance and lower latency.

Additionally, a cloud based system could be accessed from anywhere, enabling remote work and collaboration between locations. Regression testing will be much faster, focusing on specific changes in the system, and making developments more flexible and easing frequency.

Beyond this quick summary, there are multiple additional avenues for advancement, all of which the Group continues to monitor and consider. For GSS, we remain excited about what these advancements will enable and are both proud and confident that our vision, for long-term sustainability is secure, enabling us to continue servicing all client needs well into the future.

In this air of optimism, I am happy to present this Newsletter, once again showcasing the strength of our entire GSS family.

Happy reading!

New data sharing features are also in scope for Unicredit’s digital journey. This is fundamental especially as regulatory and compliance requirements are requiring faster, near real-time data from custodians, in addition to normal SWIFT channels. For us it’s clear that client demands differ, and Unicredit continues to operate and facilitate different communication channels, including SFTP, MQ and API, all in order to meet client expectations and strategies.

However, this can only be achieved with clean and high-quality data. For more than a year now, our locations have allocated considerable capacities to cleaning and structuring data , all aimed at harmonizing and providing state of the art reporting and paving the way for further innovations, one example being the processing of tokenized digital assets.

During the most recent meeting of the supervisory board of the European Securities and Markets Authority (ESMA) in July 2024, Eduard Müller, board member of the Austrian Financial Market Authority (FMA), was �re-appointed as a member of the Management Board of ESMA. The supervisory board is composed of the ESMA Chair and six other voting representatives of the 27 national supervisory authorities alongside the ESMA Executive Director and a representative of the European Commission who has been installed to ensure that the authority properly meets its legal mandate and correctly performs all the tasks assigned to it. These include, among others, developing the annual work program, preparing the annual budget, and planning the authority's staff as well �as the annual report.

With this appointment, FMA managers are currently represented in management positions in all three European financial market supervisory authorities. Beside Eduard Müller, FMA board member Helmut Ettl is deputy chairman of the European banking supervisory authority EBA (European Banking Authority) and the FMA head of insurance and pension fund supervision Peter Braumüller is also deputy chairman of �the management board of the European Insurance and Occupational Pensions Authority (EIOPA). Given this strong presence of the Austrian market regulator in the EC regulatory framework, a firm alignment and strict adherence of the Austrian Capital market infrastructure to the EC market governing bodies is accentuated.

Source: Financial Market Authority Austria

Strong embeddedness of the Austrian Financial Market Authority in the European Regulatory Framework for Financial Markets

Austria

Austria

Croatia

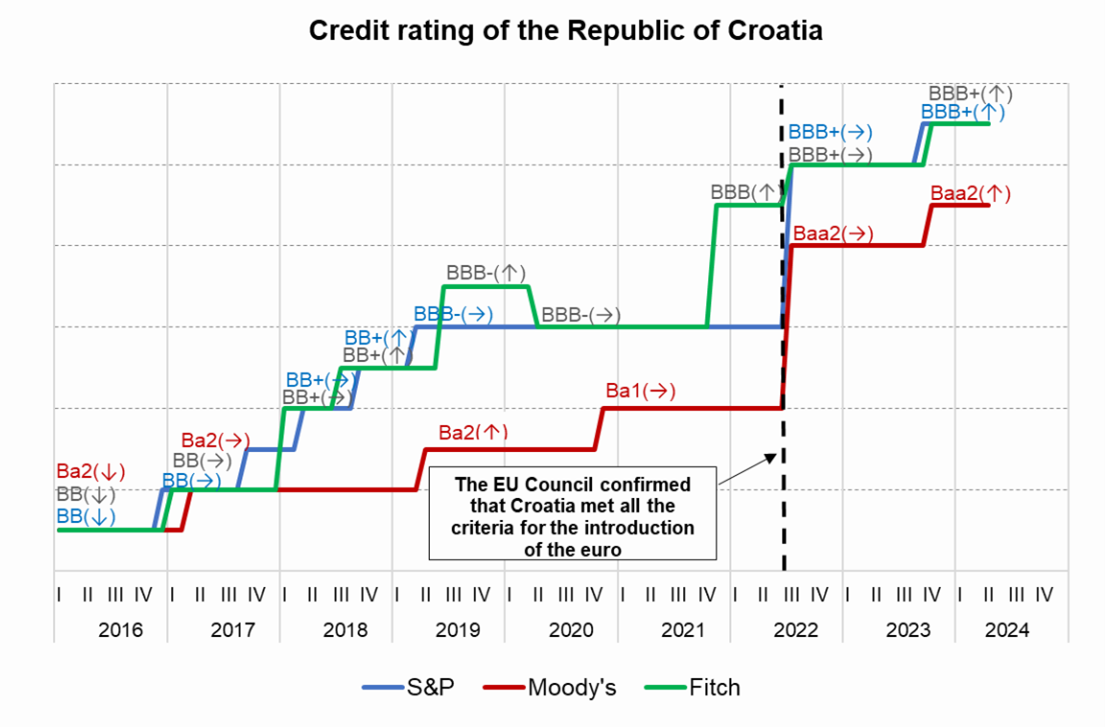

Moody’s released its sovereign rating review on 10 May with the current rating at Baa2 and positive outlook kept unchanged. Croatia’s ratings are supported by a level of strength in its institutions and governance as well as fiscal strength that are higher than that of rating peers. High institutional effectiveness underpinned Croatia’s adoption of the euro in 2023, while the government debt burden remains on a declining trend. Moody’s expects the Croatian economy to continue growing at a strong rate of 3.3% in 2024, one of the highest growth rates in the euro area.

Fitch released its sovereign rating review on 5 April. The current rating at BBB+ and positive outlook, is kept unchanged. At the end of 2023, Croatia’s real GDP was almost 16% higher than the pre-pandemic level of 4Q19 and the country is expected to grow on average by 3.2% in 2024 – 2025 compared with 1.1% forecasted for the eurozone. High nominal GDP growth and prudent fiscal policy have led to a substantial reduction of public debt. The positive outlook reflects Croatia’s resilience to recent external shocks.

S&P released its sovereign rating review on 18 March. The current rating at BBB+ and positive outlook is kept unchanged with a neutral stance, reiterating arguments and positions from the autumn review maintaining a wait-and-see approach. They repeated this statement from the last review: “We could raise the ratings over the next 12 months if Croatia’s economic resilience is sustained, supported by the country’s deepening integration with Europe, and facilitated institutional improvements, for example within the judiciary, education, and broader business environment. We could revise the outlook to stable if Croatia’s economic performance does not improve as expected. Such weakening could come about if the Russia-Ukraine conflict led to increasingly severe economic consequences across Europe or if inflationary conditions significantly worsened. Net emigration trends and an aging population also represent a long-term risk to Croatia’s growth and public finances.”

Credit rating of Croatia

Croatia

The Financial Supervision Commission and the Ministry of Finance have both announced that in August 2024 the Organisation for Economic Co-operation and Development (OECD) successfully completed its review of supplementary pension insurance in Bulgaria, confirming the compliance of the Bulgarian legislation with OECD recommendations on the key principles for private pension regulation. The review began in 2023 as part of Bulgaria’s accession to the OECD. The OECD has also noted that Bulgaria should consider including certain features which could contribute to improving the pension system in the country, such as:

OECD Successful Review of Supplementary Pension Insurance in Bulgaria

Bulgaria

the introduction of the so called ‘multifunds model’, encompassing funds with different investment profiles.

a review of the rules determining the investment opportunities to achieve growing profitability.

The Ministry of Finance has highlighted that joining the OECD is one of the leading priorities of Bulgaria as it is expected to contribute to the country’s sustainable economic development and financial stability.

Bulgaria became an OECD accession candidate in 2022. The country’s history of engagement with the OECD dates back to the early 1990s and has grown ever since, in part through the active work of Bulgaria with the OECD South East Europe Regional Programme since its establishment in 2000.

At the end of 2023 Croatia reached the highest credit rating in its history. A positive outlook was granted by all three agencies and an upgrade of the credit rating to A is expected. The fiscal position is solid, though with a widening deficit, the continued downward trajectory of the public debt ratio would be a strong signal for rating agencies that the country has a sustainable fiscal policy. This could enable Croatia to reach an A rating in later rating reviews, more likely after receiving strong indicators with the new budget plan for 2025. The untouched positive outlook gives some hope that a rating upgrade might be in the cards as soon as the autumn cycle of reviews. Risks to overall growth in the short term seem balanced now with domestic demand, EU funding and EMU integration on one side and risks to net external demand and private investment on other.

In July 2024 the Ministry of Finance sent a draft law amending the Act No. 256/2004 S. on doing business on the capital market to the interdepartmental comment procedure.

The draft law transposes Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments (MiFID) and is related to Regulation (EU) No. 600/2014 of the European Parliament and the Council on markets in financial instruments (MiFIR).

The draft law primarily responds to the transfer of provisions from MiFID II to MiFIR regarding the synchronization of trading hours and the prohibition of receiving payments for the direction of instructions (payment for order flow – PFOF), further clarifies the definition of a systematic internalizer and, in response to the energy crisis, explicitly introduces the obligation to suspend trading in the event of an emergency.

The aim is to increase data transparency, remove obstacles through the establishment of a consolidated business information service, optimize business obligations, reduce the administrative burden for entities operating on the EU financial market and support further developments of the capital market.

The interdepartmental commenting procedure on the draft law amending the Capital Market Business Act initiated

Czech Republic

UniCredit Bank Hungary is committed to contributing to the development of the Hungarian financial market by engaging in projects and initiatives that support both major and medium-sized enterprises. This is evidenced by its cooperation with issuers in supporting the launch of the exchange traded fund, OTP CETOP ETF, and its recent joint efforts with the Budapest Stock Exchange to improve the competitiveness and growth opportunities of small and medium-sized enterprises (SMEs).

Under the initiative, BSE-UniCredit Lounge, the two institutions will pool their resources and expertise to support companies in accessing the necessary knowledge, financial resources, and expert network -thereby strengthening their presence on the capital markets and achieving sustainable growth.

The cooperating parties organise regular meetings, training sessions and events for the managers of selected companies. These events are attended by experts from UniCredit Bank and BSE, investors, managers of listed companies, consultants, and trainers. The companies involved can benefit from ongoing mentoring, access to technical materials for market and stock market entry, and access to financing opportunities such as corporate finance services and reduced fees.

The Budapest Stock Exchange and UniCredit Bank Hungary join forces to strengthen the market position of medium-sized companies

Hungary

Going public is a major and crucial decision in the life cycle of a business and can be a key to its further development. We want to support our medium-sized business clients who are already listed or will become listed in the foreseeable future in successfully preparing for this step, through the BSE-UniCredit Lounge cooperation – with forums and training courses designed to share knowledge, skills, and professional contacts. In addition to our colleagues who are experienced in the process of going public, other key participants, lawyers, auditors, etc., will share their valuable experience. We consider it an important task to contribute to the sustainable growth, transformation, and competitiveness of our corporate clients. This is also the aim of the BSE-UniCredit Lounge cooperation and the recently announced "UniCredit for CEE" initiative of our banking group, which offers valuable financial, account management and advisory solutions and supports our corporate clients in Central and Eastern Europe in achieving their ambitions", underlined Albert Hulshof, Head of UniCredit Bank Hungary’s Corporate Division.

“Becoming a listed company is a very important and determining decision in the life cycle of a company, which can also be the key to its further development. In the effective preparation for this, we want to support our medium-sized company clients who are already ready to be listed or will become so in the foreseeable future within the framework of the BÉT-UniCredit Lounge cooperation – with forums and trainings created to share knowledge, skills and professional contacts. During the preparation, in addition to our colleagues experienced in the process of entering the stock market, other important participants, lawyers, auditors etc. share their valuable experiences. We consider it our important task to contribute to the sustainable growth, transformation and competitiveness of our corporate clients. The BÉT-UniCredit Lounge cooperaton and our bank group’s recently announced "UniCredit for CEE" initiative also serve this purpose, which offers actual financial, account management and advisory solutions and supports our business clients in Central and Eastern Europe in achieving their ambitions".

The Financial Supervisory Authority (FSA) is implementing the necessary steps to fulfill the National Strategy regarding the development of the capital market in Romania for the period 2023 – 2026, with the establishment of a national central counterparty as an objective included in this strategy. In this context, FSA proposes to amend the FSA Regulation no. 3/2013 in order to extend the deadline of September 8, 2024 for submission, by CCP.RO, of the additional documents required for authorization. It aims to extend the deadline for submission by a sufficient period. – According to a Financial Supervisory Authority site press release on July 31, 2024.

Romania

The Board of Directors of the National Bank of Romania decided to cut the monetary policy rate by 0.25% in each of the last two consecutive meetings held on July 5 and August 7, 2024. Starting August 8, 2024 the monetary policy rate is 6.50% p.a. – According to a NBR press release on August 7, 2024.

On July 29, 2024 the Bucharest Stock Exchange (BVB) launched a new index, Bucharest Exchange Trading Energy, Utilities and Financials (BET-EF), dedicated to the best represented sectors in the capital market (aside from investment funds) -energy, utilities and financial,. The BET-EF methodology allows a variable number of constituents in its structure, without imposing a maximum number. The starting structure of the BET-EF index includes 11 companies from the Main Market, selected based on liquidity as well as free-float market capitalization. The initial value of the index is 1,000 points. – According to a BSE press release on July 29, 2024.

The rating agency Fitch in its latest report for Serbia increased the outlook for obtaining an investment grade rating from stable to positive, while maintaining the rating at BB+.

This rating by Fitch comes after the rating agency Standard & Poor’s raised Serbia’s prospects for a credit rating increase in April of this year. According to the assessment of two of the three most influential world rating agencies, Serbia found itself half a step away from a historic success – obtaining an investment grade credit rating, which, from the point of view of the credit rating agencies, will place Serbia in the group of countries recognized for years by market participants as having a high certainty of investment.

The decision to improve the prospects for increasing Serbia’s credit rating was made based on the resilience shown by the domestic economy amid the turbulent period of the previous years, during which a strong external position and a declining path of public debt were preserved, along with an investment cycle that should support the acceleration of economic growth in the short and medium term.

The Fitch agency explained its decision by emphasizing:

Fitch Increased Serbia’s Prospects for Obtaining an Investment Grade Rating

Serbia

Local Stock Exchange – The Bratislava Stock Exchange (BSSE) became a full member of the Federation of European Securities Exchanges (FESE). By meeting the requirements, BSSE became part of the broad family of European stock exchanges in the FESE on June 1, 2024. Full membership in FESE underlines the credibility of the BSSE as a stock exchange institution, meeting the same high standards as other members.

The stock exchange is honoured to be a part of this prestigious organization and is looking forward to all the opportunities and challenges this membership brings.

The main benefit of membership is the possibility to share the know-how, best practices and key information with other capital markets. In addition they can use the experience and knowledge of other stock exchange institutions. The membership also opens the door to international projects in which the BSSE can actively participate.

Being a part of FESE enables the BSSE to react more flexibly to events at the European level, since FESE actively represents its members in influencing and creating European regulations.

For the BSSE, a relatively small European player, this membership brings increased importance and influence in defending the interests of the domestic capital market in the European Union.

The Bratislava Stock Exchange became a full member of the Federation of European Securities Exchanges

Slovakia

Slovenia

On 23 May 2024, the National Assembly of the Republic of Slovenia adopted the Act amending the Financial Instruments Market Act (ZTFI-1C). The amendment entered into force on 15 June 2024. The changes in the amen-ded Act mainly cover the topics of sustainable investments and reporting.

The amended Act transposes Directive (EU) 2022/2464/EU of the European Parliament and of the Council of 14 December 2022 on corporate sustainability reporting into Slovenian national legislation.

The amended Act also regulates in detail the implementation of the following European Regulations which are directly applicable in Slovenia:

Amended Market in Financial Instruments Act

Regulation (EU) no. 2020/852 of the European Parliament and of the Council of 18 June 2020 establishing a framework to promote sustainable investment,

Regulation (EU) no. 909/2014 of the European Parliament and of the Council of 23 July 2014 on improving the regulation of securities settlements in the European Union and on central depository companies, and

The main change created by the amended Act that is relevant to inter-national clients, is the definition of a financial instrument for the purpose of defining investment services and transactions, whereby financial instru-ments also include financial instruments issued using distributed ledger technology, as specified in Regulation 2022/858/EU (DLT Pilot regime).

This change in the definition of a financial instrument establishes a legal framework for the potential issue of financial instruments issued based on distributed ledger technology in the Slovenian market. Established by the preliminary discussion with the local CSD, no issuers have currently announced any plans to issue securities based on DLT. The CSD will announce to its members all the relevant details on such instruments (identification, classification, any other relevant information) in due time, in case any of the issuers announces plans to issue securities issued based on DLT.

Regulation (EU) no. 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to promote sustainable investments.

INTRODUCTION

NAVIGATOR ARTICLE

NEWS

BULGARIA

AUSTRIA

CZECH

REPUBLIC

CROATIA

HUNGARY

ROMANIA

SERBIA

SLOVENIA

SLOVAKIA

© 2024 UniCredit S.p.A. - All Rights reserved

UniCredit

General Company Info

Privacy

Disclaimer

Accessibility